No one wants to pay more tax than they need to on their earnings. The key to minimising the tax you pay on your music teaching fees is to maximise the deductions. So what can you deduct from your fees before the tax office wants a slice? Well the key test of what is tax deductible is whether something is what HMRC call ‘wholly and exclusively’ for the purpose of the business. So, while the sheet music you buy for your students clearly passes that test, however, if you attend concerts for ‘inspiration’, it is unlikely that HMRC will accept that this is purely business.

If you rent premises in which to carry on your teaching, then clearly that cost would be tax deductible. But what happens if you work from home? How much of your ordinary household expenses can you deduct because you work from home?

- What area of your home do you use for business purposes?

- How much can be actually attributable to that part? For example, metered heating, lighting and so on

- How long the business part is in use.

Richard teaches cello at home. One room is used as a studio and keeping his records. The room is used for nothing else. He estimates that this area around 10% of the house. His household expenses are £6,000. This includes mortgage, home insurance, council tax, water rates and fuel. He would therefore deduct 10% of his total household expenses against his income (£600).

If the room also sees non-business usage, then you must apportion by time.

Gill writes music for school productions and works from her dining room. She estimates that the proportion of the house which she uses is 5% of the total area. But the room is also used by her family, for meals and homework. She estimates that she uses the dining room for around 75% of the day, with others using it for the remaining 25%.Her expenses are £5,000 for the year. She would claim 75% × 5% of £5,000 (£187.50).

HMRC provides guidance on this on its website, with examples given in Business Income Manual 47825.

Capital gains tax problem

The problem with apportionment is that it can cause issues when selling.

When you sell a property in which you live, any gain is tax free. But if you are claiming you use part of the house wholly as an office, you do not live in that part, and the gain relating to that part is liable to capital gains tax. So, Richard could have a problem. If he sold his property and made a profit of £50,000, then £5,000 of that would be liable. As it happens, this would be covered by his ‘annual exemption’, that is the amount he can make without paying capital gains tax.

Gill would not even need to consider this issue because there is no part of her house which is solely used for business.

If the capital gains tax issue is likely to occur, then it is advisable to use the ‘office’ for private use occasionally. If you are using a bedroom, therefore, any private use would include family staying over during the holidays.

Simplified basis for expenses

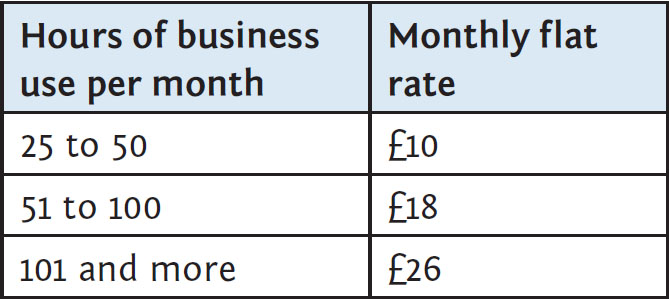

The basis for claiming some expenses has now been simplified. Individuals working from home for more than 25 hours per month can claim expenses using a flat rate; this is based on the number of hours worked from home, so apportionment is unnecessary. Telephone and internet expenses can still be claimed in addition to the flat rate by calculating actual costs.

| Hours of business use per month | Monthly flat rate |

|---|---|

| 25 to 50 | £10 |

| 51 to 100 | £18 |

| 101 and more | £26 |

The advantages of this method are its simplicity and the lack of issues when selling the property. You should calculate which method is more advantageous, based on the actual usage and home size.

Someone in a small flat would probably find the first method advantageous, especially if they used the space privately for part of the year. However, someone in a larger house, where business use was small, would probably benefit from the simplified method. The length of time you live in the property is also relevant. Live in a house for many years, and the gain when you sell could give you a problem.

It is up to you to choose the method which suits you.

Please note that this article is intended for informational purposes only and should not be taken as a substitute for specific advice concerning your personal tax situation.